The recent back-to-back interest rate cuts have sent ripples through the Vancouver real estate market. With affordability a persistent challenge, many homeowners and potential buyers are wondering if this is the right time to make a move. Let’s delve into some historical data and current market trends to shed light on this question.

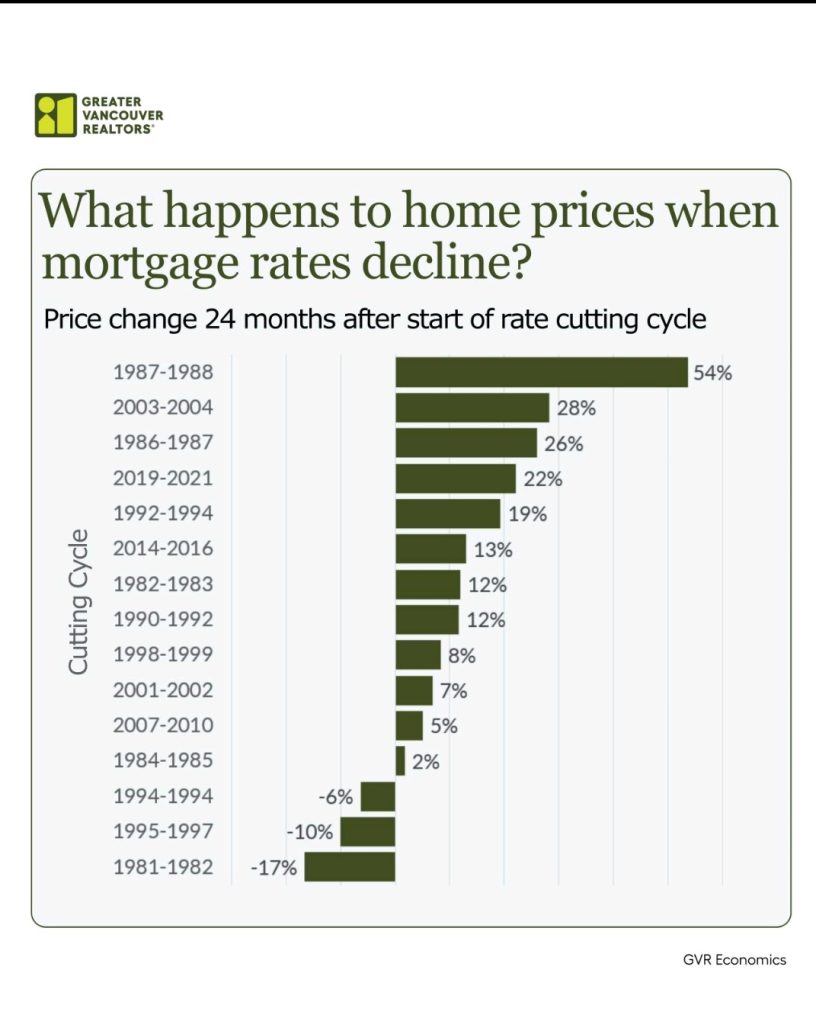

The above recent Instagram post by the Greater Vancouver Realtors highlighted a compelling trend: home prices, 12 out of 15 times, tend to rise following interest rate-cutting cycles. The data is clear: in the past, the majority of interest rate-cutting cycles has been followed by a period of home price appreciation. While past performance is not indicative of future results, this historical pattern is certainly intriguing.

It’s important to note that the magnitude of price increases has varied significantly. While some periods saw explosive growth, others experienced more moderate appreciation. Factors such as economic conditions, immigration levels, and supply and demand dynamics all play a role in shaping the real estate market.

Currently, Vancouver’s real estate market is experiencing a period of relative calm after the frenzied activity of recent years. While prices have not plummeted, they have stabilized, providing some relief to buyers. This, combined with the recent interest rate cuts, has created a more balanced market compared to the seller’s market conditions of the past.

However, it’s essential to remember that Vancouver remains a desirable city with a limited housing supply. This underlying scarcity can drive prices upward over time significantly if economic conditions improve and immigration levels rebound.

Reasons to Consider Buying Now:

Factors to Consider:

The decision to buy a home is a significant one that requires careful consideration. While the current market conditions in Vancouver present an opportunity for buyers, it’s essential to conduct thorough research and consult with a mortgage professional to make an informed decision.

As a mortgage broker with a deep understanding of the Vancouver market, I can help you navigate these complexities and find the best mortgage solution to meet your needs. Feel free to reach out for a personalized consultation.

Disclaimer: This blog post is intended for informational purposes only and does not constitute financial advice. It’s essential to consult with a qualified professional before making any investment decisions.