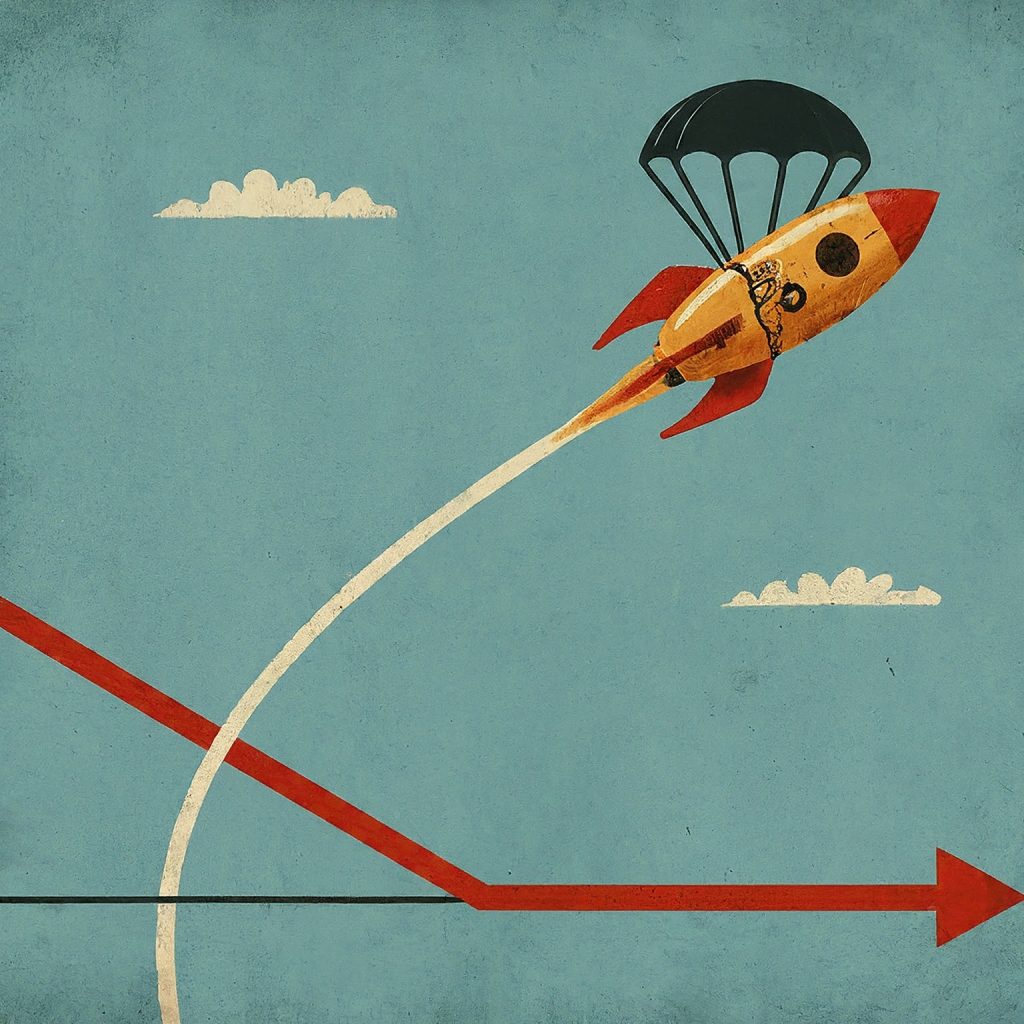

For Canadian homeowners, the past few years have been a rollercoaster ride of interest rates. We’ve seen them climb steadily, much like a rocket ship blasting off, fueled by inflation concerns. But buckle up because there are signs we have reached the peak, and a gradual descent is on the horizon.

The Bank of Canada, our central Bank, has been raising interest rates to combat inflation. The rising rates have, of course, impacted fixed mortgage rates as well. However, the Bank recently signalled a potential slowdown in rate hikes, suggesting we may have reached the top of the tightening cycle. Imagine our rocketship deploying its parachute – a sign of slowing ascent and a controlled descent.

It’s essential to understand the difference between the Bank of Canada rate and fixed mortgage rates offered by lenders. The Bank’s rate directly impacts variable rate mortgages, but fixed rates react with a time lag. This lag is like the wind slightly buffeting our descending rocketship; variable rates will likely adjust quicker than fixed rates as the Bank of Canada eases its grip.

For potential homebuyers, this could be a window of opportunity. While fixed rates might not plummet immediately, they are expected to decline over the rest of 2024 and into 2025 gradually. Keep in mind that rates will most likely not drop steadily; instead, they should drop a little, then shift side to side, and then fall further. ( Rocketship with a parachute descending with the winds blowing it side to side)

While waiting for rock-bottom rates might be tempting, there’s a strategic way to enter the market now. Consider a variable-rate mortgage or a hybrid option. The variable rate mortgage will most likely start to drop and allow you to lock into a fixed rate at a lower rate in the future. Hybrid mortgages, which combine fixed and variable portions, offer a balance between predictability and potential future savings. With either option, you’d be securing a home today while positioning yourself to benefit from future rate drops. This approach allows you to jump into the market now while keeping an eye on the potential for even greater affordability down the road.

If you’re already a homeowner with a variable-rate mortgage or a fixed one coming up for renewal, you may want to consider your options to take advantage of the rate declining into late 2025. However, this is a personal decision, and consulting a mortgage broker is crucial to assess your specific situation.

The interest rate landscape is constantly evolving, but signs are pointing towards a gradual decline in the coming months and the year ahead. Remember, navigating mortgage decisions can be complex, so don’t hesitate to reach out for personalized guidance. Together, we can chart the best course for your financial future.